By: Kristopher E. Twomey, Esq.

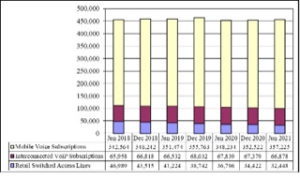

According to FCC data from 2021 (See, chart below), the U.S. has 67 million U.S. Voice Over Internet Protocol (VoIP) subscribers. This compares to only 32 million wireline phones. Those VoIP numbers today grow year-to-year, while its core predecessor, Plain Old Telephone Service (POTS) is rapidly declining, at 11.6% annually. Ultimately, the nation’s POTS networks will be relegated to a specialized service, rather than a once-ubiquitous presence. Indeed, POTS is likely to go the way of payphones.

Retail Voice Telephone Service Connections, 2018 – 2021 (In thousands)

Source: FCC Voice Telephone Services Report, August 2022

On the Fixed Wireless Access (FWA) front, as demand among both business and residential customers surges, hundreds of WISPs have added VoIP to their services mix. VoIP is attractive, because it often adds profitable recurring revenue, plus it increases overall profit margins, entices new subscribers, improves customer stickiness, and reduces churn. Given the ease of adding VoIP services through white label wholesalers, WISPs risk losing ground to competitors, by failing to offer VoIP. That said, for a balanced analysis, it is important to note that VoIP revenues do come with some added regulatory costs and federal/state regulatory obligations. Moreover, despite some persistent myths floating around, VoIP is subject to a slew of federal and state guidelines and restrictions, ones that should not be ignored. That said, with the proper strategy, compliance can be simplified and even save money, for both the WISP and its customers.

Federal Financial Considerations

Almost all WISPs are at least somewhat familiar with the Federal Universal Service Fund (“FUSF”). This is in large part because the FUSF charges its fees on top of an operator’s transport bills. As a VoIP provider, WISPs too, are, in turn, responsible for billing and collecting FUSF from their customers. By April 1st annually, the WISP must file a 499-A form with the Universal Service Administrative Company (USAC), the entity responsible for managing the federal universal service programs. This details the operator’s VoIP and company revenue. When a VoIP provider owes less than $10,000/year for FUSF to the USAC, USAC considers the company to be a de minimis provider. Initially then, the wholesale carrier will charge and remit FUSF on the WISP’s behalf. As VoIP revenues surpass approximately $3,500/month, a WISP will owe more than $10,000 in FUSF, and become a direct contributor to USAC. At that point, the wholesaler will cease charging FUSF. This will trigger quarterly filings that estimate VoIP revenue. Called 499-Qs, these forms are akin to filing estimated taxes.

Billing customers for FUSF can be challenging, and must comply with the FCC’s truth-in-billing rules. The FUSF “contribution factor” changes every quarter and is currently 32.6%. FUSF can only be charged on interstate and international revenue, so the FCC decided that 64.9% of a bundled local and long-distance VoIP product is subject to FUSF. This is referred to as the “safe harbor.” For example, for a customer receiving VoIP service at home for $20, $13.50 of that is subject to FUSF, at a total of $4.40, based on this quarter’s contribution factor. There are also various FCC charges that are not usually billed to customers. These include local number portability, telecommunications relay funds, the North American numbering pool administrator, and an FCC annual regulatory fee. Those are calculated based on the 499-A data and invoices that are sent by those fund’s administrators.

States’ Financial Considerations

States also issue various regulatory fees, such as surcharges, sales taxes, utility user taxes, and excise taxes. If the FCC’s 64.9% VoIP interstate revenue safe harbor calculation is used, the remaining 35.1% would be considered intrastate revenue and is subject to state USF charges. For states with their own USF programs, most require annual filings, but some are quarterly, some are even monthly. There is no de minimis status for state USF, so wholesale carriers cannot collect it and VoIP providers are solely responsible. Additionally, all but four states have various 911 fees, varying by county and municipality.

As a result, that customer’s $20 invoice must include charges that make it look more like $25-30 on a customer bill. There are perfectly legal ways to massage this, including calculating actual interstate usage and filing a traffic study with USAC. This process can substantially reduce the amount owed to USAC from the 64.9% safe harbor calculation. Especially for business customers, recategorizing some types of VoIP revenue can reduce regulatory surcharges, as well.

Federal and State Regulatory Filing Obligations

FCC Filings

In addition to financial reporting, VoIP services create many federal regulatory compliance responsibilities. The FCC requires various filings on several issues, some key ones of which are noted below:

- CPNI: VoIP providers must follow the FCC’s rules on Customer Proprietary Network Information (“CPNI”) rules. CPNI includes customer data like name, address, and services ordered, and it must be secured. There are three CPNI compliance components: 1) an annual certification statement, promising CPNI was protected due by March 1st, 2) an employee handbook, and 3) employee training.

- Customer Reporting: Providers must enter their VoIP customers into the FCC’s new Broadband Data Collection System, just like broadband coverage data.

- Certification: FCC record-keeping compliance certifications must also be filed, on an annual basis.

- Robocall Blocking: The FCC has aggressively sought to reduce robocalls and illegal marketing calls. VoIP providers must file robocall mitigation plans in the FCC’s database.

- CALEA: Providers must also follow Communications Assistance for Law Enforcement Act (CALEA) requirements. These include preparing and filing a Systems Security and Integrity Manual, with the FCC and FBI. Wholesalers usually provide compliance with CALEA technical standards.

State Filings

- Almost every state requires some form of VoIP provider compliance, also including monthly filings.

- Registration: 22 states require some form of registration, and a dozen have state USF programs.

- E911: Monthly reporting of 911 customers and surcharges is necessary.

- Taxes: Sales tax, utility user tax, excise tax reporting are required.

- CPNI: Several states require CPNI filings to be shared.

- Subscribers: Some states require reports on total VoIP subscribers and their locations.

Note, this article is not meant to be a complete listing of every requirement affecting VoIP providers in any given state. New and existing VoIP providers should make themselves aware and/or seek qualified assistance, to ensure that they achieve and maintain regulatory compliance for their VoIP operations.

Kristopher E. Twomey has exclusively represented competitive telecommunications and broadband Internet providers for 25 years. He started his firm in 2002 and limits its representation to CLECs, fiber to the premise developers, wired and fixed wireless ISPs, managed service providers, as well as VoIP and UCaaS providers.

Kristopher E. Twomey has exclusively represented competitive telecommunications and broadband Internet providers for 25 years. He started his firm in 2002 and limits its representation to CLECs, fiber to the premise developers, wired and fixed wireless ISPs, managed service providers, as well as VoIP and UCaaS providers.